13th Annual Rosenkranz Debate & Luncheon

Listen & Download

Description

The 2021 National Lawyers Convention took place November 11-13, 2021 at the Mayflower Hotel in Washington, DC. The topic of the conference was “Public and Private Power: Preserving Freedom or Preventing Harm?”. The final day of the conference featured the thirteenth annual Rosenkranz Debate.

RESOLVED: Concentrated corporate power is a greater threat to individual freedom than government power

Featuring:

- Mr. John Allison, Executive in Residence, Wake Forest University School of Business; Former President and CEO, Cato Institute; Former President and CEO, BB&T

- Mr. Ashley Keller, Partner, Keller Lenkner LLC

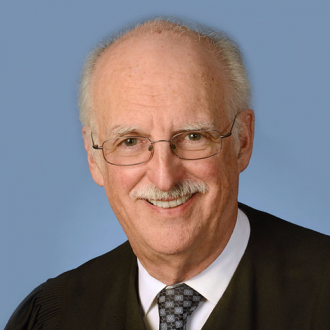

- Moderator: Hon. Douglas H. Ginsburg, U.S. Court of Appeals, D.C. Circuit

Event Transcript

Eugene Meyer: Good afternoon. Good afternoon, everyone. Welcome to our 13th Annual Rosenkranz Debate. My name is Eugene Meyer, and I want to express our gratitude to the Rosenkranz Foundation for supporting this event for more than the last decade. We love having this Saturday centerpiece for our convention, which is an intellectually sharp, one-on-one debate between two highly prominent legal theorists and public policy experts. It has been quite a distinguished career.

We’re privileged to have moderating this year’s debate Judge Douglas Ginsburg of the U.S. Court of Appeals for the D.C. Circuit. He’s not only been a great friend of the Society and a wonderful judge, but he’s also done some superb and invaluable work with A More or Less Perfect Union, his three-hour program for PBS on the Constitution emphasizing the importance of originalism which premiered in January 2020, and when COVID-19 closed the schools, was broadcast repeatedly on stations throughout the country.

In September of this year, he released Civic Fundamentals, comprising 100 two-minute videos addressing the questions on the naturalization test and explaining the history and the philosophy behind the answers. His aim is to get these materials into classrooms of a million students per year, and there is a brochure on this on most of your tables. To introduce our debaters and to conduct the debate, I am honored to call on Judge Douglas Ginsburg.

Hon. Douglas H. Ginsburg: Thank you, Gene. Welcome, federalists and friends. The debate this year, the resolution, is concentrated corporate power is a greater threat to individual freedom than government power. I must admit that until I saw this formulation, I had never thought about this question. And yet, I think it’s a terrific question, and we’re going to have a very informative debate bringing out the nuances of this.

Our debaters are, for the affirmative, we have Mr. Keller here, Ashley Keller, who is a partner in Keller Lenkner LLC. He has a fascinating background. I think he represents clients in a wide variety of practices and types, including antitrust, my particular interest. And he’s one of the leaders of Keller Lenkner’s products-liability practice as well. Ashley represents numerous states in antitrust litigation against Google for monopolizing products and services, services used by advertisers and publishers in the online advertising market.

What did I want to say? Yes. Before launching the law firm, Ashley cofounded a litigation finance firm, fascinating aspect of his background, which grew to more than $1.3 billion in assets under management and was the world’s largest private investment manager focused on legal and regulatory risk. That firm was acquired by Burford Capital in 2016.

Before all of that, Ashley was a partner at Bartlit Beck in Chicago. He was a law clerk for Judge Posner on the Seventh Circuit and for Justice Kennedy on the Supreme Court. He was educated at Harvard College, received his real education at Chicago, where he got an M.B.A. from Chicago Booth School of Business and a J.D. from the University of Chicago Law School, where he was graduated first in his class from a school that still ranks its students. Somewhat Burkean, I think.

Then, in the negative here of the resolution, we have John Allison, a name known to many of you. He’s now Executive in Residence of the Wake Forest University School of Business. But John is a member of Cato’s Board of Directors and Chairman of the Executive Advisory Council of the Cato Institute’s Center for Monetary and Financial Alternatives. He was president and CEO of Cato from 2012 to 2015. Before that, he had been chairman and CEO of the BB&T banking firm, which was the tenth largest financial services company in the United States.

He’s the author of The Financial Crisis and the Free Market Cure: Why Pure Capitalism is the World Economy’s Only Hope and of The Leadership Crisis and the Free Market Cure: Why the Future of Business Depends on the Return to Life, Liberty, and the Pursuit of Happiness. John is a Phi Beta Kappa graduate of the University of North Carolina-Chapel Hill. He received his master’s degree in management from Duke University, and he’s a graduate of the Stonier Graduate School of Banking. He’s also been the recipient of six honorary doctorates. Oh, my goodness, I just heard. I agree.

The ground rules are these. The affirmative will begin with 15 minutes. Remember the resolution is that concentrated corporate power is a greater threat to individual freedom than government power. So we’ll begin with the affirmative case for 15 minutes from Ashley Keller, and then from John Allison the negative for 15 minutes. There will be time for rebuttal after that. So, Ashley, you are on.

Ashley Keller: Thank you, Judge Ginsburg, and may it please the federal courts.

Concentrated corporate power is the greatest threat to the people’s cherished liberties. And throughout our history, that wasn’t true. Government was our greatest threat, and the framers knew it. As Thomas Jefferson noted, “When the people fear government, there is tyranny. When government fears the people, there is liberty.” Or as the father of our nation reputedly said, “Government does not reason. It is not eloquence. It is force. Like fire, it is a dangerous servant and a fearful master.”

That was true at the dawn of our republic and remained true throughout our history. Each successive generation of Americans has an obligation to remain vigilant against abuses of government power. Ronald Reagan used different but no less eloquent words than the framers to modernize their warnings about government. He opined that the nine most terrifying words in the English language are, “I’m with the government, and I’m here to help.”

I’m distressed to report something that many in this room already know. We seem to have just crossed over a key inflection point in American history, where government power is no longer the people’s greatest threat. It’s still a menace, to be very sure. And we must never ignore that front of the unending battle to preserve our God-given freedoms.

But those of us who care about individual rights must now confront a rear-guard action, where massive corporations are pursuing a common and mutually agreed upon agenda to destroy American freedom. In our time, the nine most terrifying words in the English language are, “I’m Facebook, and I know what’s best for you.” You can substitute Facebook for Meta, or Alphabet, Amazon, Coca Cola, Goldman Sachs, JP Morgan, Twitter, or Walmart, and your level of terror should be undiminished.

Defenders of freedom must face reality. The Chamber of Commerce is not our friend. The C-suite grandees who finance it are not our friends either. They were erstwhile allies of convenience, and they are now the enemies of a freedom-loving people. To support that contention, I’d like to start with the why. Why is it that concentrated corporate power is such a menace today? I think it’s actually the intersection of several different problems. And, no, this is not me embracing intersectionality.

The first problem we face is the swelling ranks of so-called woke people, who are completely and unabashedly opposed to individual rights. And you don’t have to take my word for it. Just ask the woke-atariat. They will unapologetically tell you that America’s founding was an immoral act designed to solidify white supremacy, that the Bill of Rights is racist, the right to freely express controversial ideas is a form of micro-aggression, the right to practice traditional Judeo-Christian values is a pretext for marginalizing powerless communities.

If you choose not to speak in favor of a cause you don’t support, well, guess what? Silence is violence. Choose instead to condemn looting, arson, and lawless mayhem, guess what? Destruction of private property isn’t violence. It’s just a peaceful protest intensifying to repair a past injustice.

These views are incompatible with American conceptions of individual freedom. And it doesn’t take a Rhodes scholar to observe that these views are not evenly distributed throughout our population. The 70-year-old farmer in Kansas is not equally likely to be woke as the 25-year-old software engineer in Silicon Valley, oh, no. The woke-atariat is composed almost exclusively of young, highly progressive people, which means, in turn, that the exercise of individual freedom that they seek to suppress is the freedom of moderates and conservatives. Those are the people, if the woke have their druthers, who can’t speak freely, can’t freely exercise their religion, enjoy their property rights, or avoid race-based discrimination.

Now, because I do support individual freedom, normally I would not offer up these toxic viewpoints as an excuse to enlist the heavy hand of the state. The cure for puerile, mendacious speech is mature and enlightened speech. So, in an ideal world, I would favor someone with a lot more patience than I have explaining to these misguided snowflakes that they live in the greatest country on God’s green earth.

The only reason they’re allowed to spread manifest calumnies about America is because they are enjoying the freedoms that only America provides. If they want to really understand a society without individual freedom, I suggest they go to Xinjiang and spend some time in the public square protesting the Chinese Communist Party’s brutal oppression of the Uyghur Muslims. In fact, I’ll splurge for the airline ticket. The Chinese Communist Party will splurge for the reeducation camp. There’s no need for Uncle Sam to do anything.

But, alas, the highly liberal woke ideology is not our only problem. The second problem we face is that, seemingly overnight, corporations have almost uniformly abandoned Milton Friedman’s shareholder primacy model of the firm. What does that mean? Milton Friedman had this crazy idea. The purpose of a company is to make money, not to take shareholder resources to support social agendas or the private interests of officers and directors. Now, this, of course, doesn’t mean that CEOs can’t support political causes. Of course, they can. Of course, they should. But they should do it with their own money, not the official infrastructure brand and massive treasuries of the companies they run. Think of it as a Hatch Act for corporate officers.

For my entire life at least, corporations more or less adhered to Friedman’s model. There were, admittedly, a few questionable incursions into public policy and social issues. But even then, at least the companies had the decency to lie to me about it, pretending that they were doing this to maximize profits. Companies aren’t pretending anymore. Thanks to the emergence of so-called stakeholder primacy, corporate officers and directors now brazenly admit that they are making decisions that don’t maximize profits.

So how do they make decisions? Well, it’s with every conservative’s dream come true, a Justice Breyer style multi-factor balancing test. Sure, sure, shareholder profit, that’s important. We’ll consider that. But so is the company’s commitment to the environment and the employees and our communities and to the world writ large. And when you weigh all of those things together, voila, corporate agents can do whatever the hell they want.

And what do they want? Why, to virtue signal to the woke, of course. That’s why CEOs routinely alienate more than half of their customers by spewing lies about voter ID laws that 80 percent of Americans support. It’s why your inbox is flooded with daily emails from companies you patronize, explaining how they plan to discriminate on the basis of race in order to fight racism.

Hey, Gillette, here’s a news flash. I buy your razor blades because they do the least bad job of getting the stubble off my face. I don’t give a damn what you’re CEO thinks about political science, so stop with the spam, for the love of God.

Once again, this new form of corporate waste in itself doesn’t support government regulation. If a bunch of foolish businesses want to abandon the profit motive, that should mean other businesses can start with a laser focus on profit. Those businesses should have a lower cost of capital and will steal a huge swath of customers who want their razors cheap and their razorblade manufacturers politically neutral. So my instinct is always let the invisible hand work. Let the market correct itself.

But we can’t because of the third reality we face, which, coupled with the first two factors, creates a problem that cries out for a solution. Corporations today have a durable concentration of market power. Tech giants, like Facebook, Amazon, and Twitter have natural monopolies that can’t be easily displaced. Other companies wield monopolistic market power, not by themselves, but by using third party organizations to facilitate horizontal agreements that in aggregate prevent normal market-correcting mechanisms. When we apply this trio of factors to individual freedoms, the results are terrifying and implicate the same concerns that justify protecting individual freedoms from government power.

Let’s take as an example the freedom of speech. What’s the common rationale for preventing the government from controlling the content of speech, or worse still, suppressing one side’s viewpoint? It’s that we can’t trust government bureaucrats, however well intentioned, to separate true ideas from false ones, and so a vigorous marketplace of ideas is the lifeblood of republican society. No matter how controversial or uncomfortable an idea might make someone, individuals have a right to air all views, and we trust a free and informed people to decide for themselves what is true and what is false, and then to support in the voting booth leaders who share that perspective.

That rationale stands undiminished if you replace a government censor with a private, all-powerful one. Facebook, Twitter, and Amazon, with some $3 trillion in market capitalization between them, each have durable monopolies in the dissemination of various forms of content. Because each company no longer adheres to Milton Friedman’s view of the firm, each has and continues to throttle, alter, or outright suppress content, even if that means fewer advertising views and thus lower profits.

And because these tech giants obviously cater to or are run by young, woke liberals, the profit-destroying speech that they suppress is almost universally moderate or conservative viewpoints. I don’t trust the government to choose which viewpoints are true or false, but I sure as hell don’t trust Mark Zuckerberg, Jack Dorsey, or Jeff Bezos to do so either.

As another illustration, let’s consider a person’s right not to be treated differently on the basis of race. Why is this right vis-à-vis government written into both the constitution and the statutes at large? It’s because it’s deeply immoral for the government to wield its awesome power to punish or reward people on the basis of an immutable characteristic. Yet, examples abound of corporations acting in concert to flagrantly violate this right.

Here’s an example that may strike a little close to home. A legion of Fortune 500 companies are using third-party organizations like Diversity Lab to agree with each other that they will only purchase legal services from law firms that staff their matters with 33 percent minority lawyers.

Do you remember the good old days, when liberals promised that diversity was just a plus factor and quotas and racial floors would never be countenanced? Well, AT&T, Coca Cola, Facebook, General Electric, Hewlett Packard, Microsoft, Pepsi, 3M, Walmart, and scores of other companies with trillions upon trillions of dollars of market capitalization have all agreed with each other to change that paradigm. Lawyers can’t avoid discrimination on the basis of immutable characteristics when more than half of the clients who purchase legal services collude to implement these deeply immoral quotas. It is indeed assorted business, this divvying us up by race. It also is and must be illegal business.

Or how about companies forcing employees to go through morally bankrupt critical race training that’s more redolent of something cooked up by the Ministry of Love than a McKenzie inspired efficiency seminar? To the CEOs out there who are pretending not to know any better, George Orwell meant 1984 as a dystopian cautionary tale, not your instruction manual.

Your so-called educational sessions are segregated by race and teach that America is a white supremacy system. Whites who believe in merit, objectivity, capitalism, color blindness, or that we are all equal in the eyes of God are guilty of racist thoughts. They can’t improve until they accept their guilt and shame, embrace the idea that white is not right, acknowledge that they are racists, and then pledge to take on a newly created anti-racist identity.

This is not the claptrap being heard in some obscure professor’s office hours, oh, no. This is required content at Walmart, a $400 billion company with 1.6 million American employees. They make 14 bucks an hour. They’re not privileged or entitled. They just face a daily struggle to pay the rent and make ends meet.

What’s more, the CEO of Walmart is Doug McMillon. He makes a little more than $14 an hour, and he’s using his perch as the president of the business round table to get other Fortune 100 companies to force this same racist prattle on their workforces. If Doug McMillon wants to spew lies about America and engage in the cruelest irony by branding people racist solely because of the color of their skin, he ought to have the decency to reach into his own pocket to finance that noxious speech. The $22 million that Walmart shareholders pay him each and every year is more than enough for him to get started.

As for the hapless employees who are being subjected to this disgraceful treatment, in many geographic markets, Walmart is by far the largest employer of low-skilled labor. And if it’s permitted to band together through a trade organization with other employers who agree to force this content on employees, the fact that labor is mobile is a Hobson’s choice. It is no answer to say to a low-skilled, low-income worker, “You’ve got the right to avoid race-based treatment on pain of losing any chance at a sustainable livelihood.”

It is crystal clear, to me at least, that something must be done about our present predicament. And I’m the first to concede none of the problems I’ve just articulated violate the Constitution. So we need to work with statutory law. And given the current political climate, it would be ideal if this was a law that was already on the books rather than pinning our hopes on new legislation.

Hon. Douglas H. Ginsburg: One minute.

Ashley Keller: Now, if only we had a statute that prohibited abuses of monopoly power or prevented horizontal conspiracies in restraint of competition. Ah, yes, we have a long tradition of vigorously enforcing the antitrust laws for the societal good, and my proposed solution is to do so here. We should define product and geographic markets the same way. Courts should impose the same injunctive remedies for violations as they always have.

The one twist that is warranted by the present circumstances is that courts should consider difficult to quantify harms to competition when analyzing anti-competitive effects. If huge corporations aren’t going to focus solely on the bottom line, in violation of the Milton Friedman principle, courts shouldn’t do so either. Conspiracies to aggregate market power to deprive people of their cherished liberties imposing calculable damage on the foundation of American society. They should be unlawful per se.

Hon. Douglas H. Ginsburg: Thirty seconds.

Ashley Keller: And huge monopolies that attempt not just to make monopoly profits but to remake American society in the way that a half dozen billionaires might prefer does similar irreparable harm to the American way of life. Article III judges, I implore you to do your jobs and put a stop to this madness before it is too late.

Hon. Douglas H. Ginsburg: John, I take it that your remit is now to tell us that all of that, notwithstanding, that of government power is still worse. So have at it.

John Allison: All right. Well, first, thank you for the invitation to be here today. I have a very high regard for The Federalist Society. Frankly, there are not many attorneys outside of The Federalist Society who are strong advocates for limited government and free society. I’ve had the genuine pleasure over the years of working with Gene Meyers, and I’ll tell you he’s been a great person to work with and very productive.

I am a banker instead of an attorney. So I may have a slightly different perspective world view, although I’ve been fortunate to work with a lot of world-class attorneys over the years. During my 40-year tenure at BB&T, including 20 years of CEO and 3 years of CEO of Cato, I’ve had an interesting experience of working with many government regulators and politicians at all levels. It’s been an education, I’ll tell you that.

I would say, interestingly enough, I don’t disagree with Ashley on a lot of what he said, and I’m taking a very different approach. What I disagree with is that business is a cause in that. Every issue that he’s raised were forced on businesses, and that’s what people don’t really understand. The regulatory impact on business is subtle and very powerful. Resolution concentrated corporate force is a greater threat to individual freedom than the government. It’s not. That’s just the fact. Governments have guns.

You think corporations just go around and do what they want to do? No, it don’t work that way. Sorry. Walmart can offer you great prices, special deals, etc., but they can’t make you buy their products. The government can make you. They can take your property. And by the way, they do that a lot, a lot more than people realize. You see that in the banking business. They can put you in jail. They can kill you. In fact, governments throughout history have killed hundreds of millions of people. Government is about power, and it is potentially extremely dangerous.

When I was working at Cato, we had many horror stories about government. Is cronyism an issue? And I really actually thought this was what we were talking about. It absolutely is. It’s a significant problem in good times. Congressmen, senators are often for sale, for rationalization. I think if congressmen were always for sale, almost everything Ashley talked about wouldn’t exist. They’re not always for sale. The irony is that cronyism goes away very quickly in the bad times. It only takes a little change in administration, like Obama versus Trump versus Biden, and all the rules change, which makes it very difficult to operate.

Let me talk about a few examples of some things that I’ve been personally involved in. Citigroup, which was the largest financial institution in the world, has been the classic crony capitalist over the years. In my career, they failed three times and been bailed out by the government.

Interestingly enough, however, the last time they failed, they didn’t get bailed out. Most people think they got bailed out, but it didn’t work that way. The head of the Federal Reserve at that time was Bernanke. Now, Bernanke was an interesting guy. He was paranoid, is the only word I would have. In fact, he wrote a book. And in that book, he described his tremendous fear that the financial crisis was going to get much worse and was going to destroy the economies of the whole world.

I, in fact, personally thought that was bizarre. I was running a bank, and we were doing fine. Most of the normal economy in the U.S. was doing fine. The fact that Citigroup was in trouble — now, I’ll have to admit, if I had been Bernanke, I’d have taken over Citigroup, like you do at lots of failing banks, broke it up, and sold it. And the world would be a better place to live today, frankly. The banking industry would be more diversified. There’d be more competition. It’d be a good thing.

But I don’t think Bernanke took over Citigroup because of cronyism. He took it over because he was afraid that their problems would turn into a global economic collapse. In fact, when the feds took over Citigroup—and it took over a number of other large financial institutions—they chose who the CEOs were going to be. They put a number of representatives on the board, they put in a group of people to supervise the board, and they had control of those large financial institutions.

The results were horrendous, by the way. The growth—this was happening under Obama’s administration—economic growth during Obama’s administration was one of the slowest periods in U.S. history. And one reason was the banking industry wasn’t functioning very well. And Citigroup stock returns during that eight-year period were way below the market, way below the market. And it finally ended when Trump took over, and not big fan of Trump. But anyway, at least he got rid of that.

It’s not that Citigroup was saved by cronyism. I went through the corrections in the early 1980s and the early 1990s, and the economy was really in a lot worse state than it was in 2008. And yet, Bernanke and the Fed, by their actions, acted like the economy was going to go broke. And to some degree, they created very substantial problems.

Another example — I’ll give a personal example in the banking business. The bank in Alabama called Colonial Financial had been a pretty good size bank, had been very successful on paper for a long period of time. They were classic cronyists. They had connections with the local governments, the state government, and the federal government.

And then, suddenly, the FDIC, which had been giving them excellent marks, as strong as you could be for years, realized that the bank was a mess. And this happened when they ended up changing examiners at the bank. And they eventually took it over and sold it. We happened to buy the bank with guarantees from the FDIC. But there was this government regulator basically sanctioning this Colonial Bank, which allowed them to raise deposits at cheaper prices, become more competitive with other banks, when in fact, they were bankrupt all along.

Another example, and this is an interesting one, probably impacts everybody in here, home builders. Now, for 60 years, home builders have had tremendous political clout. It’s kind of off the chart. They hide behind having a home’s a good thing. They’re mostly interested in selling homes and making a profit, of course.

However, the cycle ended in 2008, 2009. And this is why cronyism never really works long term. Obama had no mercy for home builders. He didn’t like home builders for whatever reason. He didn’t like developers. And he was focused on saving individual homeowners, which is kind of a disconnect since home builders own tons of money and they’re forced to sell their houses. What’s going to happen to prices? Prices are going to fall.

The FDIC had been gutted before the financial crisis. This is how this regulatory stuff works. They had allowed tremendous risk in the home building industry. They suddenly tightened down on home builders. What was interesting, and this was not fun to go to, they hired a bunch of kids, rightly out of college who didn’t really know anything about banking or the economy because they hadn’t staffed up. They had no staff. And then they hired a bunch of guys that got failed. They hired the guy that is supervisor, that was somebody we fired. That’s an interesting person to be supervised by.

Anyway, and they suddenly changed the rules. They forced us to put home building customers, residential builders and developers, out of business that had been customers of ours for 40 years, where we dealt with the grandfather, the father, and the son in the home building business.

In the early ‘80s and early ‘90s, we had a similar — it’s actually a worse economic correction until the federal government screwed it up. And we kept those home builders in business. We worked with them. And they came out and they started building homes again. In the 2008 period, 90 percent of the home builders in the United States went out of business, 90 percent.

You want to know why housing prices are high today? The government wiped out the home building business, something that banks — we certainly never would have done. It’s a real unfortunate tragedy. It was also tough. I mean, these were good people in many cases that had had their lives ruined. We wouldn’t have a housing shortage today, home prices would be substantially lower than they are today if the Federal Reserve, the FDIC, hadn’t wiped out the home builders. Again, a craze of cronyism that worked in the good times and turned into a disaster in the bad times.

But the point of that is the government made the rules. They can be nice, and they can be nasty. They can change because of different economic environments. They can change because of different administrations, different political environments, and they do. If you actually operate a business like a bank, there’s no effort to kind of smooth things. It’s fundamentally, at the end of the day, it’s driven by the political beliefs of the president and his party.

I could go on with examples for a long time, but we don’t have time to do that. In general, in my experience, many more corporations have been crushed by the government than have been helped by the government over a longer period of time. I mean, many, many more.

By the way, the most elegant and interesting example is not a corporation, of cronyism, is the teachers unions, and that is at the local level, the state level, the federal level. They’re something. They are something. Unfortunately, I don’t have time to tell you about the teachers unions. If somebody wants to ask a question, I’d love to talk about it because I actually have a cure for what we need to do. But it really has hurt the quality of education in the United States. It’s tragic. The teachers unions, in my view, are the worst enemies of students we have in this country by far.

Here’s an interesting fact. Of the 50 largest businesses in the U.S. in 1928, only 15, 30 percent, were still in business in 2018. So 70 percent were gone. And of the 30 percent that was left, every one of them was really a different business. They had survived by changing their business. Now, if you look at the history, all those businesses that are gone at one time or another were cronyists of one kind or the other. But cronyism is suicide in my personal opinion. When we ran BB&T, we did everything we possibly could to avoid the government. We didn’t want any favors from the government. We just tried to keep them out of our business.

And I think companies that were forced — I mean, if you take a Google and a Facebook—and we could talk about this—those companies started out trying not to get involved with the government. But the government got involved with them. They came up with excuses because they like power. They like control. And the things, if you think how radically Facebook and Google’s strategy have changed, it’s not because Facebook and Google wanted to change it. It’s because if they didn’t change it, the government was going to close them down.

Capitalism by corporations is a concern and can be disastrous in good times. Based on my many years of experience working with corporate bars and running Cato, I’ll tell you with absolute certainty, in the long term, government always prevails. And, again, they have guns.

Hon. Douglas H. Ginsburg: Ashley, seven minutes to rebut that.

Ashley Keller: Thanks, Judge Ginsburg. And I neglected to say at the outset, thank you, John, for agreeing to participate in this debate. It’s a real privilege to be opposite you.

I think my principal rebuttal point is objection nonresponsive. And I say that, just like you, agreeing with a great number of the things that you said. I take a back seat to nobody in my disdain for excessive government regulation. I believe in free markets. I believe that the government will always do a poor job, even if it’s well intentioned, at trying to allocate scarce goods and resources. And so, all of these regulations that you see coming from the state and federal levels are often harming consumer welfare.

I’m a proud graduate of the Chicago School. I respect all of those principles. I can draw the supply-and-demand curve and show you the consumer surplus section of it and show you why taxes and regulation adversely impact it. That’s all stipulated to the silly government regulations that harm bottom lines and make it harder for people to get the goods and services they want are a bad idea, and we should be against them.

I also think that the thing you didn’t have time for is extremely important, and we should always make the teachers unions the object of our spleen. So that’s a point of common ground as well.

But name a single solitary government regulation that is causing the corporate malfeasance that I articulated in my opening remarks. Point to the regulation that says it’s a good idea to have racial quotas, and you should go out there and insist that law firms engage in outright violations of the civil rights laws. Show me the government regulation that says that Twitter or Facebook should throttle content and that Amazon should disallow Parler from using Amazon web services because it was the most downloaded app. You will not find anything in the CFR and the statutes at large in anything that is making corporations engage in this outrageous behavior because it’s not a problem of government regulation.

It’s not that we grew government too big and too fast, which we have, which is why I’ve always said government remains a menace. We still have to watch that front of the war. But these are corporate actors acting on their own or in concert with other corporate actors because they want a virtue signal right now in a way that is harming people’s rights.

In a different period of time, we could absolutely swing back to the situation where “I’m with the government, and I’m here to help” are the nine most terrifying words in the English language. But that’s not the moment in history that we’re in. And we have to take stock of the actual things that we’re seeing in the world.

The one point that I think is somewhat responsive and that I want to get into, you are correct—and I also agree with this point—that the government has the monopoly on the legitimate use of coercive force outside of emergency circumstances, i.e. they have guns. By the way, I’ve got guns too.

[Laughter]

John Allison: You don’t have as many as the government.

Ashley Keller: That’s right. They do have more than me, although you don’t know how many I have. I’m a collector.

But that is a point worth rebutting because I agree that the government having all of these guns and the ability to use coercive force to throw people in jail, to even execute them for certain capital crimes is an awesome power. And so we have to take it very seriously, and we cannot pretend that government is not a threat to our rights.

But I think, at least at this moment in time, we have trained the government not to use their guns in flagrant violation of our rights. We should be careful about that. We shouldn’t slip up. We shouldn’t lose our vigilance. But there are so many examples of the government trying to stray out of its lane and to impinge on the people’s liberties where they get shut down immediately, thanks in large part to many of the people in this room.

Some recent examples, the government tried to discriminate on the basis of race and give farming subsidies only to minority farmers. It got shut down in a nanosecond. California tried to force speech codes by saying you’ve got to use particular pronouns and, if you have objections to that, it could be punishable by fines that were criminal in nature. The California Supreme Court unanimously shot that down and said that’s a violation of the First Amendment. If the government ever tried to engage in the throttling of speech that Twitter or Facebook is engaged in, they would get Rule 11 sanctioned by some judges in this room because it would obviously be a violation of the First Amendment.

And so, yes, we have to worry about creep. Yes, we have to worry that the government — it’s like a velociraptor. They’re constantly testing the cage to see if it’s electrified. And if you let them get away with things, they’re going to take advantage. But at least, right now, they’re pretty well trained to realize that you can’t flagrantly violate the Constitution.

Of course, there are disagreements about constitutional principles and the scope of rights. And everyone in this room is right, and the other side is wrong. There’s generally broad consensus about what the government can and cannot do, and corporations are running amok and crossing all of those lines. And I don’t think you could point to any regulation that’s causing the corporations to do it. They’re doing it of their own accord.

Hon. Douglas H. Ginsburg: John, you have more?

John Allison: Yeah. I appreciate a lot of what Ashley said. I do think it’s naïve. It’s naïve because he’s never actually been in business and seen how the regulators operate. It’s nice to believe that we have rule of law. We kind of have rule of law. What we really have is rule of regulators, and that is a lot of our problem. And the regulators make up the law, and it changes often. It’s really hard as heck to follow the law because it depends on administrations. It depends on political environment. It depends on what’s happening in the newspapers.

This whole woke — I happen to know some of the CEOs that have come out for the woke thing. They hate woke, but they’re afraid not to be woke because the regulators will crush them. And the regulators don’t need regulations to come after you. I can tell you that from personal experience. But they can find something wrong.

And by the way, if you’re running a business, there are so many regulations, it is impossible to follow them all. You can’t do it. You can’t do it. And they can find something you — I think if you follow one regulation, you violate another. I was trying to remember some of the law — in the banking business, there are eight or ten laws that are contradictory. And the regulators decide what data to enforce the laws.

So it’s nice to say, well, the law hasn’t changed. The regulations haven’t changed. But they have changed. They change because the regulators change every time you get administrations or when you get a lot of press, a lot of press. But I guarantee you the regulators are tightening down. In fact, I know, from personal experience.

This whole thing about critical race theory, boy, that is super forced on businesses. If you’re trying to manage a business, that is a really difficult thing to deal with. I’ve heard a number of CEOs complain about it. And they have to have these training sessions, which they hate because it makes half their employees mad, and the other half don’t like them because they’re having this session. It’s not something that they do voluntarily.

The regulators are driven by politics. I mean, it’s within a range, but it’s a pretty dadgum big range. If you guys wanted to do something, make the regulators obey the law. That would be the most powerful thing you could do to improve freedom in this country because they just make up the laws. And, of course, one thing you could do is get Congress to actually write laws so they don’t have all this flexibility. And we really have rule of law, that’d be great.

So it’s not — another thing. Google, Facebook, Amazon, the probability of them being basically out of business or being a much diminished force in our economy in ten years is huge. This goes back to why I told you the example of what I saw in businesses. Businesses come and go. I knew the CEO of Google pretty well. He quit, retired because the government. They’d run their business very independently, and then all of a sudden, the government was there, and he knew he couldn’t stand it. He was a clear free market guy. He was a supporter of Cato, a libertarian think tank. But he got out because he knew the handwriting was on the wall.

The very fact that the government’s tightening up on these firms will drive them out of business because they’ll become competitors. They will come along and fill the niches that they’re leaving. There’s a lot of conservatives in this country. They may be a minority, but they aren’t going to do business with these guys that are saying, “Oh, you can’t go on Facebook.” Well, fine, then we’ll have to create our own organization. It happens. It happens all the time in business. It’ll happen again.

Yeah, government’s making more smoke. But we’re in good times, right? The economy’s booming. Things are going well. This is the time that, yeah, yeah, we’ll give money to the government, pay lip service to their big stuff. But kind of keep watching for when things get tougher, and they’ll go after a number of these firms, including firms that are trying to do what they think the government wants to do.

And, of course, you might get a change in administration because Mr. Biden doesn’t seem to be doing too well. And then, whoever comes in will probably go after the woke companies. So it’s a very interesting life. I wish it was simple that we actually had rule of law. It would be a huge, wonderful thing, but we don’t. And if you run a business, you know it every day. It’s not much fun in that regard.

Hon. Douglas H. Ginsburg: Thank you, John.

Ashley, I think one of the thrusts of John’s remarks is that looking at pages in the code of federal regulation or statutes and not finding anything that requires this or that is looking under the lamppost rather than where you left your keys. I mean, from my personal experience counseling businesses, regulated businesses, financial institutions, and telecoms, one of the most frequently heard complaints was regulation by raised eyebrow. You’re not going to find any raised eyebrow regs anywhere, but that’s the way we were regulated. I can’t attest personally to which eyebrow gets raised when an administration changes, although there’s some evidence of that in the press. So, what do you say to that?

Ashley Keller: Yeah. I appreciate the question. Just so you know, John, I have been in business, and I have been regulated by the Securities and Exchange Commission. So like you, I am afraid of regulators and don’t like when they’re in my office looking through every box and file. So I’m aware of the phenomena that you’re referring to. I’d like to think, though, that I’m not naïve, I’m just idealistic.

If you’ve got these friends who are CEOs who secretly hate the woke stuff, tell them to grow a spine and stop discriminating on the basis of race. I mean, have we gone from “I’ll pledge my life and fortune in sacred honor for the principles” to “I’m afraid of the regulator; I can’t stand up for what’s right.”? Give me a break. That’s ridiculous. And they’re violating the law in doing it. Rule of law, there are interstices. We can’t always tell what the law is. But it’s black letter law that you can’t do what these corporations are doing. These CEOs should be ashamed of themselves. And being afraid is not good enough.

John Allison: Well, I agree with that. And I personally, we fought them left and right. We never gave in. But I also understand.

And one of the interesting questions, by the way—and this is the argument they put back—is what is their fiduciary obligation to their shareholders? If they fight these regulators, their company’s going to be punished. It may be something else. It may be some of it. But it’s no way a business cannot—a big business—cannot violate tons of regulations.

So should they have their share price creamed by the regulators coming in on their business? Or should they do backflips, whatever is necessary to make regulators happy? I think that’s a tough, tough call because they would get fired, and the guy that comes in behind them won’t do that. So what will they — should you make that sacrifice? Personally, we fought them. I fought them left and right, and we won. But they’ve gotten a lot crazier, I think, than they were then.

Hon. Douglas H. Ginsburg: So if wokeism is the thing that’s in the best interest of the shareholders, what is the management to do?

Ashley Keller: Well, it’s not in the best interest of shareholders because, thank God, most of the country is not woke, and they don’t like this nonsense. But let’s make sure that we got our chronology right. This nonsense started during the Trump administration. The Brandon administration is relatively new.

[Laughter]

Was it the Trump regulators who were raising eyebrows and saying discriminate on the basis of race and throttle speech that’s good for conservatives? I don’t think so. I don’t think those regulators were raising those eyebrows. The companies were doing this of their own accord in the previous administration, and they have accelerated their misconduct in this administration. So there’s actually continuity of wokeism between these two administrations. It’s not the change of administration that’s the problem. It’s the C-suite.

John Allison: I want to react to that. Trump was pretty much discounted by the regulators. And if you think about his personality, that shouldn’t surprise you. So the regulators were running independent doing what they wanted to do. I ran into that talking to a number of CEOs.

And what did they want to do? They want control. They want power. They don’t want to be limited by the regulations. And they liked — they didn’t like wokeism, but they liked being in control. So they started moving along with it. And also, they felt Trump was going to get thrown out. They may have been wrong about that.

Hon. Douglas H. Ginsburg: We now know that for two generations, if not more, the Federal Housing Administration consistently engaged in forcing banks to redline, to create racial zones, and to avoid financing homes that would be — for customers that would be integrating a neighborhood or a block. Consistent, pervasive, never approved by any president, certainly not by President Truman, certainly not by President Kennedy, but that was the world the government gave us.

Ashley Keller: Yeah, government’s terrible too. The resolution is not corporations are the root of all evil and government is hunky-dory, because I don’t believe that, and I wouldn’t have spoken on the affirmative if it was. But I agree that that’s lawless, and it shouldn’t be permitted.

But right now, the notion that there are all these regulators out there secretly whispering into the CEOs ears, and we’ve just never heard about it saying, “You should do all this woke stuff. You should publicly say that you’re taking action not to maximize profit, even though secretly that’s not what you believe, and it really does maximize profit. And you’re doing all of this stuff because our eyebrow was raised a certain way.” Maybe that’s possible. You can never say never.

And if it comes out that that’s empirically the case, I will support the other side of the resolution then. But I don’t think that that’s what’s happening. We would have seen some evidence of it if this was driven by regulation. This is driven, I think, by the C-suite, by the CEOs, who like the psychic income they get from virtue signaling because they rub elbows with all of the people who go to the cocktail parties that New York Times folks like to go to. And they like that they’re supporting those causes that a very small sliver of elite people in this population like but the overwhelming majority of Americans disdain.

John Allison: Or could I —

Hon. Douglas H. Ginsburg: — Oh, sure, John.

John Allison: Because I have experienced some of what you were talking about, very interesting. When Bill Clinton was elected president — this is an old experience, but it’s an interesting experience. When Bill Clinton was elected president, he had a lot of support from the minority community. And he promised that he would end racial discrimination in the banking business.

There had been a study done by the Federal Reserve in Boston that showed there was discrimination. Now, the study ended up being totally discredited. It had nothing to do with reality. And there’s not motivation to racially discriminate. If you’re in the banking business, you want to make all the good loans you can. You have to not be in business to believe you’re going to turn down people that can pay you back, and you can make money. You don’t understand how competitive the world is.

But anyway, Clinton made this promise to his minority constituents. And so he literally sent the FDIC around to find banks discriminating against minorities. He basically told it. And they went around the country and they found banks “guilty of discrimination.” And the deal was, if you’d plead guilty, they’d come up with a fine—it was a high fine, but it certainly wasn’t a killer fine—and they’d leave you alone. So a ton of banks did that.

Well, they came to BB&T and accused us of discrimination. Well, a lot of our customer base is minority. At that time, we were operating in eastern North Carolina, which was agriculture minority area. I was CEO. And we said, “Wait a minute.” The way they tried to do discrimination is they would come up with these cases they had where we’d turn down a loan and we had made a similar loan.

Well, we said, “Well, let’s look at your evidence.” And we looked at the evidence, and it was crazy. The loans we turned down, we should have. We’d have been doing the bar a terrible disservice. They couldn’t pay it back, and we’d end up owning their home. And the ones we made, we should have made.

We weren’t guilty. And we said, “We’re not guilty.” We hadn’t done anything wrong. Well, they said, “That’s fine. We’re only going to do a few things. You can’t open any new branches. You can’t do any merges and acquisitions. And we’re going to audit over the next six months literally with a team of 50 people,” on top of their normal audit team all auditing the bank.

So we ended up hiring a firm because we weren’t experts in dealing with regulators on issues like this. And we started producing lots of evidence that we weren’t racially discriminating. And they just basically threw it away. I mean, what they were going to do is keep the pressure on us so long that we had to say uncle because we needed to open branches. We needed to do merges and acquisitions, or we would get bought. And that was their whole strategy.

Fortunately, for us, I don’t know if you guys remember this—probably you’re not old enough—two years in, Clinton, his Democratic supporters got wiped out, and Congress suddenly was Republican. The next day, the next day—this goes to rule of law and regulators—the next day, the regulators call and say, “Hey, we really didn’t mean it. We’re gone with no problem. You can open your assorted new branches.” That’s a true story. That’s a true story. That’s what rule of law looks like when you’re really trying to run an organization.

Hon. Douglas H. Ginsburg: Well, on that sad note, I think we should take some questions from the audience. But we’re not going to vote on which is worse, Sodom or Gomorrah.

[Laughter]

But we would like to get some input from the audience. Paul, is it? I’m sorry, over there.

Isaiah McKinney: Isaiah McKinney. I’m a 3L at Wake Forest. Could you please speak to or argue against the ways in which government has picked winners and losers by regulating selectively and for creating and crafting regulations favorable to these big woke corporations but also unfavorably towards smaller potential competitors?

John Allison: I didn’t hear the question exactly.

Hon. Douglas H. Ginsburg: I’m not sure of it.

John Allison: Yeah, repeat the question.

Hon. Douglas H. Ginsburg: We need you to repeat the question a little louder.

Isaiah McKinney: Could you speak to the ways in which the government regulations have picked winners and losers by crafting regulations that are favorable towards these big woke corporations but are unfavorable towards smaller competitors that could threaten their quote, unquote, “monopoly”? How has government regulation been selective rather than equally applied, and how has that caused part of this problem? Or, if it hasn’t, how has it not caused this? How is that not part of the problem?

John Allison: It’s a huge problem. The way they do it is by making them regulate — it’s not like they want to drive out small businesses, although sometimes they do want to drive out small business because it’s harder. They wanted to reduce the number of community banks in the United States. It’s conscious strategy because they’re harder to regulate, that many banks. It was intentional.

But anyway, in general, that’s not necessarily their go. But they create such complex regulations that the regulatory cost kills the small business. And I can tell you that from when I was at BB&T. Fortunately, when we started, our regulatory cost was manageable. But as we got bigger, our regulatory cost exploded. And the community banks, the smaller banks, were facing that same kind of thing. And I saw it over and over with businesses.

In a small business, since they can put you — they can close you down. They technically, in many cases, can put you in jail. If you’re running a small business and your regulatory costs go up, and you’re the only person in the business that can handle that regulation, they’ll drive you out of business. And I’ve seen that thousands of times in small businesses in the banking business.

And it wasn’t necessarily what the regulators go, it was just the effect of highly complex regulations. I mean, you should read some of these regulations. I’m sure you have. But think about them from a business owner’s side. He’s not an expert on the law. He doesn’t have a whole bunch of — can’t afford to have attorneys working for him and has to do that while he’s running his business. It’s a killer. That helps the Googles, by the way.

Hon. Douglas H. Ginsburg: Ashley, do you want to comment on that?

Ashley Keller: Very briefly, I agree that I don’t think government regulation is targeting pro-woke versus anti-woke corporations. I think government regulation, as John just said, tends to favor, whether intentionally or unintentionally, big corporations with a lot of resources.

But that is actually very problematic with respect to the woke issues that I was talking about because just think about the small businesses who are actually struggling to compete with each other in your local neighborhoods or whatever. Does your local neighborhood restaurant do this wokeism stuff where they say, “White customers get seated second, even if they come in first”? Do you see your local gas station that’s a sole proprietorship engaging in this nonsense?

No. They actually have to compete in the free market. Their margins are razer thin. They’re like true competition. They’re the things that we should be supporting. But the government regulatory environment, again as John has articulated, tends to favor incumbents and big, massive corporations.

Paul Kamenar: Well, thank you. Judge, is this on? Yeah. Paul Kamenar, a local attorney that filed comments with the SEC opposing their Nasdaq Board Diversity Rule, which is pending in the Fifth Circuit. Lot of what we’re talking about is laid out very well in Vivek Ramaswamy’s book Woke, Inc, who spoke yesterday. And I highly recommend everybody get that book.

And there’s another one that came out a couple weeks ago by Professor John McWhorter of Columbia who wrote a book on woke antiracism. And just want to make one little reference here in the book, where he says, “A friend of mine on Facebook said that they agree with Black Lives Matter only to be roasted by an anonymous person who said, ‘Wait a minute. You agree with them? That implies you get to disagree with them. That’s like saying you agree with the laws of gravity. You as a white person don’t get to agree or disagree when black people assert something. Saying you agree with them is every bit as arrogant as disputing them. This isn’t an intellectual exercise. It is their lives on the line.’” I’m omitting all the all caps and the exclamation points in this.

My question to Mr. Allison is in terms of the remedy you spoke about, maybe the antitrust laws. Could you comment on the current lawsuits challenging Twitter and Facebook being a state actor because of the exemption they get in Section 230? By the way, a couple weeks ago, all those cases were transferred to California based on the form selection clause of the Twitter account.

Hon. Douglas H. Ginsburg: End of question, go.

Ashley Keller: Sure. So I’m not steeped in the facts of that complaint or the allegations contained in that complaint. I am skeptical of the idea that just because there’s a government statute or regulation that means that there’s a concerted action between the government and the private business.

But I’m still, as you alluded to, in favor of using the antitrust laws where appropriate to break up monopolies or to force monopolies to stop engaging in the sort of behavior that we were talking about. And the quote that you just read is exactly the sort of ridiculous, disgusting nonsense that makes me throw up in my mouth.

Roger Severino: Thank you. This is Roger Severino from the Ethics and Public Policy Center. As a former civil rights regulator, I agree with Judge Ginsburg that it’s not just regulation by raised eyebrow. What I found was regulation by phone call. We would get complaints on all sorts of civil rights statutes. I was at HHS. And our staff, great career folks, would just pick up the phone and say, “Hey, fix this,” whether or not the law was actually on their side.

And I want to say that you’re both right. It is woke CEOs. It is also regulators. I don’t think every CEO is, by nature, woke. But I do think that you have the HR departments are listening to those phone calls, listening to the guidance documents that are coming out of — and they came out of — we put a tamp on it during the Trump administration. But it’s hard to erase all of it.

And those HR departments are then putting the CEOs that want to do the right thing in this bind, and you have very mostly conservative general counsels in these corporations saying, “Hey, we don’t want to bring the ire of the regulators.” So it’s almost a symbiotic thing, where the ones that want to do it use the regulators as an excuse, and those that don’t, they feel pressured on the inside. What are your thoughts on that dynamic?

John Allison: I think that’s true. I think they’re true. I think, a lot of times, maybe the CEO really is opposed to it, but his legal staff says, “Hey, we’re going to get sued.” His HR people say, “Oh, we’re going to have terrible internal problems.” And a lot of them really do stuff they don’t really agree with because they’re afraid of the internal implications.

I do want to tell you one story about regulators, though, that I think you’ll find interesting. It’s an interesting story. When the financial crisis happened, I was adamantly opposed to government bailouts. I didn’t think they were necessary. I thought it would just — some of the banks like Citigroup ought to fail, and the world be a better place to live. I really did. And I did the worst crisis by far in 1980 and 1990. Then, of course, Congress approved the TARP program. I was opposed to the TARP program before it got approved. I went to Congress—I almost never do this—and tried to get people to vote against it. It failed the first vote, passed the second vote.

The day after TARP failed—now, this is an act that I tried to work against—I got a call from our regulator. And he was almost embarrassed, and that’s tough for regulators. But he said, “John, we know that you have far more capital than is required under current regulations and you haven’t had a single quarter loss during the financial crisis. However, we’ve got a team together that’s coming and audit your bank tomorrow, and we’re confident that they’re going to find some serious problems that you don’t know about.”

Okay, we got the message. So I said, “Oh.” I said, “How do we avoid that?” He said, “Well, you just to have to agree to participate in TARP, this bailout,” because Bernanke, who was head of the Federal Reserve, wanted to force the healthy banks to participate to make it harder for people to know who the bad banks were. So he forced the healthy banks to participate.

And interesting enough, it cost us a fortune. We didn’t need the money. We had money coming out of our kazoo-boo. And it cost us $100 million unnecessarily. And then, as soon as we heard about an opportunity to get out, we tried to get out. And it took us months to get out because they were making a ton of money on the healthy banks, and they were using that to cover their losses on the unhealthy banks. Unbelievable. Unbelievable. In that case, it wasn’t exactly the regulator, but it was if you go all the way to Bernanke. That was something Bernanke caused to happen.

Hon. Douglas H. Ginsburg: Recover from that, and take another question.

Mike Daugherty: I’m Mike Daugherty with LabMD. I’d like to have your commentary about the game of dodging the judiciary in the regulatory state. My experience has been big corporations — I had a commissioner at the FTC recuse herself. Now, she’s buried in Microsoft when she was saving the world before in Vermont.

And then, all the rules the administration state, if you’re a small business, like I was, without the pro bono defense I had gotten for a decade, I would have never gotten to an Article III judge. And I felt that was intentional hands around my ankles, like don’t you dare get to the judiciary. Do you think the judiciary understands for every person they see, there’s 20 other companies that couldn’t even get through it? And do you think the judiciary understands how rare and how intentionally avoided they are?

Hon. Douglas H. Ginsburg: Well, I can’t speak for much of the judiciary, just myself. But I am aware that, not only is it difficult to get to us, you have to really persist. You have to win before the administrative law judge, get reversed by the FTC, go to the circuit, and that takes — that’s a losing money proposition. You have to do it on principle. And a few companies do it, very few, because obviously — I’ve had a lawyer say to me, “Because of Chevron, I cannot in good faith advise a client to take an appeal.” That’s pretty scary, I think. So, yes.

Joe Cosby: Thank you. Joe Cosby. I practice in D.C. And for both Mr. Allison and Mr. Keller, isn’t even this topic a little bit avoiding maybe the big elephant in the room, which is culture? The CEOs, regardless of how much of a spine they have, are definitely going to be afraid of the wave through the millennials and their employees. And quite a few of them are afraid of what Twitter is going to say about them with the Twitterati. As Bari Weiss suggested, the editor of The New York Times is now Twitter.

And with respect to the argument that the government has the guns, sounds like the argument that Stalin made about the pope. And I think the pope won that battle and that the culture, in fact, may be the lead thing in both cases about both leading the government and the business environment. So isn’t it the culture that’s really at issue, and what would you do about those things?

Hon. Douglas H. Ginsburg: That’s a very interesting question. John?

John Allison: I don’t think it’s typically the culture because I don’t think the business could have survived if it had the kind of cultural defect that I think you’re describing. I do think some CEOs have a lot less courage than others, and that’s definitely true. I would be surprised many of them really want woke, but I think some of them just don’t have the courage to do it. I know having had, as I just told you a few minutes ago, we faced down the regulators several times. It ain’t much fun. It gets scary, and you can make it — it’s an interesting question. It’s a question the attorneys kept throwing back at us. Are we really acting in the shareholder’s best interest to fight the regulators?

And that’s a tough call objectively in business. I mean, you got this, I call it a moral commitment to the shareholders. And a lot of the stuff that these fights, are you fighting for your shareholders? Maybe you can argue that in 20 years, but that’s a long time to figure out where this stuff is going. Are you fighting for you because you really just oppose, you think what they’re doing is morally wrong? I’ll be honest, in our case, we thought we were fighting for our shareholders, but we also were doing it because we thought we had the moral high ground.

Ashley Keller: Yeah. I mean, I think culture is a problem. But we can only debate one problem at a time. But, yeah, if you look at what kids are being taught in schools, I relocated my family because I was deeply uncomfortable with what my children were being taught in their private school that still had the unions that you and I don’t like.

And if you have an entire generation of people that are raised to think that America is a structurally evil place and that the Bill of Rights is racist and all the other claptrap we’ve been talking about, eventually that’s going to take effect. But as Bari Weiss also said, the solution to this problem is courage. And by the way, it doesn’t take that much courage to stand up to the millennials. They are paper tigers. For goodness’ sake, if you’re the CEO of a Fortune 500 company and you can’t stand up to them, find another job.

Hon. Douglas H. Ginsburg: We have five minutes left. Please make your questions very brief. And no comments, just questions.

Benjamin Pugh: Good afternoon. Benjamin Pugh from Huntington Beach California. The question I had was an issue I don’t think I’ve heard talked about yet, which is the unprecedented power of big tech and the big woke corporations to control the government by controlling what information is disseminated during elections. And it’s not just censoring a Hunter Biden laptop story or inventing a Russia collusion hoax. But ten years ago, the way you won a Congressional election was with mailers, walking door-to-door, flyers, sometimes you’re on the news. Now, you buy ads on Facebook that are targeted. Now, you buy YouTube ads.

Hon. Douglas H. Ginsburg: We have the question.

Benjamin Pugh: That’s pretty much the primary avenue to control the elected officials.

Hon. Douglas H. Ginsburg: We got your point.

Benjamin Pugh: And those corporations have their finger on that ability to censor.

Hon. Douglas H. Ginsburg: Let the gentlemen answer.

Ashley Keller: I think that that’s a very important point, and I tried to touch on it. But like I said, a free and robust marketplace of ideas is the lifeblood of republican society. And if you have monopolists who are controlling which ideas get out into the marketplace, that is a huge problem.

I am not worried about targeted ads because I trust adults to be able to discern what’s true and what’s false. But I am concerned that only one side’s viewpoint can’t get out into the marketplace. That impacts how people vote. And by the way, something we didn’t touch on, it impacts whether people accept the results of an election, which we often hear people complain about, rightly, that in a democracy, the losers are the most important party. Well, the losers are not going to accept the result, just like in banana republics, if they don’t think they had a fair shake to persuade their fellow citizens.

John Allison: I want to say a quick addendum to that, something we looked at Cato. I don’t think that’s actually true. If you look at the last election, almost all the press was pro-Biden. And yet, Trump, who had very colorful characteristics, almost won. And if you look at the people that voted at Trump, they voted at Trump, not because of the newspapers, because they saw what Trump did. So all the positive press for Biden and the negative press for Trump was not the deciding factor in that election, not if you ask people in survey what you were doing.

Ashley Keller: Almost won also means just barely lost. And just barely lost, why? Maybe because the information wasn’t even-handed.

John Allison: I think he lost because of what he had done as president.

Joshua Kleinfeld: So my name’s Joshua Kleinfeld. I’m a professor at Northwestern Law School. And I just want to observe and think about the generational divide in the conservative movement that we’re seeing almost symbolized on stage. As I watch the two of you, I’m of the same generation as Ashley. John, well, it’s interesting. Watching the two of you talk is like me and my dad having a conversation over the dinner table.

John Allison: I’m glad you didn’t say granddad.

Joshua Kleinfeld: My dad is a Reagan appointee to the District Court and a George H. W. Bush appointee to the Circuit Court. And he came up in the Reagan version of the conservative movement, where the problem was inefficient and hapless government. It was the source of oppression, and it was the source of inefficiency, and the free market was the solution. And then there’s this younger generation who have the same goals. We have the same goals as you, which is a liberty-loving America, but we’re observing that there’s some new kind of market failure. There’s some new kind of problem that makes that old Reaganite conception of how oppression works mistaken.

So I know my time is limited. I want to try — I’m not just an observer of this generational divide. I am on one side of it decisively. Ashley is right in his contentions here. The reason why, the thing that we are seeing that some of the older generation is not seeing is that there has been a shift from oppression through governmental power to oppression through ideological power. The shift is coming from an ideologically unified ruling class coming through elite schools and then populating our elite institutions. And those elite institutions are diverse. It could be Goldman Sachs. It could be your Jenner & Block. It could be your local school board. But there is a unified ideology —

Hon. Douglas H. Ginsburg: — Professor, you have succeeded in running out the clock so that there is no time for an answer.

Joshua Kleinfeld: — that is a real issue of the fight here.

Hon. Douglas H. Ginsburg: You’ve used the time. There is no time for an answer. I think we understand what you’ve said. It’s not really a question, but we heard you.

Please join me in thanking the combatants.

Ashley Keller: Thanks. Great job.

Hon. Douglas H. Ginsburg: Terrific.

Ashley Keller: That was a lot of fun.

John Allison: I enjoyed it.